Cloud Financial Management Software

Comprehensive Financial Application Suite – Simple Enough for Small Organizations and Comprehensive Enough for Multinational Businesses

Acumatica Cloud Financial Management Software ticks all the boxes that accounting software should have, coupled with integrated business management applications allowing you to manage your entire business from a single platform. Connected project accounting and customer management close the loop on financials for project-driven companies with financial insights by customer.

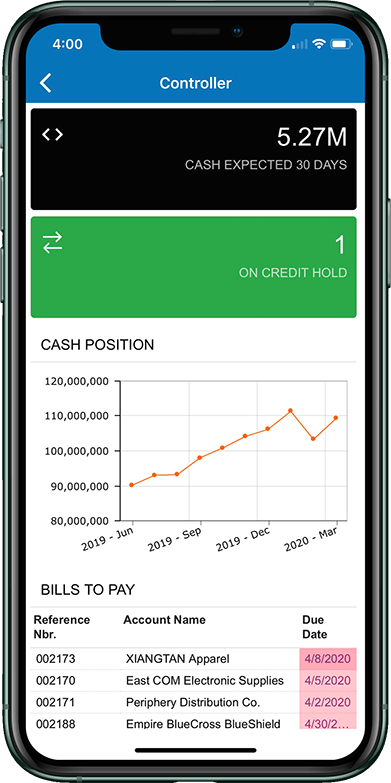

Enjoy a complete view of your financials from anywhere, using any device. Easily create or modify financial reports with the Analytical Report Manager. Choose a solution that enables your business to operate more efficiently. Automate critical processes using workflows that are easy to configure and modify as your requirements change. Gain real-time visibility into business performance with dozens of out-of-the-box financial reports and personalized dashboards. Enable staff to collaborate using the same information in real-time within Acumatica’s centralized database.

GROW YOUR BUSINESS WITH EASE

Add unlimited users at no additional cost. Never again pay for additional users. Use intercompany accounting to track financials and create reports separately for an unlimited number of related companies within your organization. Seamlessly conduct recurring billing across customers, accounts, districts, organizations, channels, and product lines. Automate processes with scheduled bank feeds, expense receipt creation, and mobile applications for expense receipt capture and time entry.

Choose Acumatica Cloud Accounting Software and streamline your deferred revenue accounting, tax management, and fixed assets accounting.

Acumatica Financial Management Software Features & Capabilities

Gain Instant Access to Timely, Accurate Financial Data with Comprehensive, Flexible Reporting and Analysis.

General Ledger (GL) is the central repository for your financial information, including a chart of accounts, financial periods, ledgers, and allocations. Because GL is fully integrated with the entire Acumatica system, you can make entries in other modules and post them to GL.

Flexible GL account and sub-account structure. Define the structure of your General Ledger accounts and sub-accounts. Organize your reporting and analysis configuration by defining segments, segment lengths, and segment values.

Account and sub-account security. Control roles and access permissions by account and sub-accounts to protect sensitive data and improve accuracy. Limit “on-the-fly” sub-account entry to specific sub-accounts based on pre-defined combinations of segment values.

Reporting from multiple dimensions. Create different views of the data, or dimensions, using Acumatica sub-accounts. Nearly unlimited reporting dimensions are available to slice financial reports by product, department, or any user-defined segment. Consolidated and summarized data can be displayed in the monthly, yearly, and quarterly views.

GL consolidation. Combine data from multiple entities for consolidated reporting and analysis, notwithstanding different currencies or different account structures. Adjustments for minority interests, intercompany transfers, and other transactions are preserved to avoid duplication.

Manage Customer Accounts and Improve Collections by Automating Processes and Tracking Receivables.

With the Accounts Receivable (AR) module, you can generate invoices, send statements, collect and apply payments, verify balances, track commissions, and deliver customer reports. Get comprehensive reporting that’s accessible anywhere, any time. Accounts Receivable is fully integrated with all other Acumatica modules.

Flexible invoice and statement delivery. Gain greater control over how you create and deliver customer invoices and statements. Format statements for printing, HTML, or PDF delivery. Keep full records for future reference and auditing.

Recurring billing. Create contract templates to apply and manage a wide range of fees, overage charges, and minimum charge amounts. Specify start and end dates, renewal terms, a billing schedule, and line items. Include billable hours and customer support hours in bills.

Credit card processing. Accept PCI-compliant credit card payments with the flexibility to handle manual charges, transaction voids, and refunds. View credit card transactions and issue warnings about expiring credit cards. Connect to any bank processing center with included plug-ins— or build your own using our SDK.

Deferred revenue recognition. Use deferred revenue codes for individual line items at invoicing to support your revenue recognition requirements. Acumatica will recognize the current part of deferred revenue and generate the right transactions.

Parent-child credit policy. Configure parent-child relationships between the customer accounts that represent your branches or franchises. Manage credit control on the parent account level.

Track Money Owed, Available Discounts, Due Dates, and Cash Requirements. Access Reports Anytime, Anywhere Using a Web Browser.

Manage vendor invoices, automate payment processing, predict cash requirements, track vendor balances, optimize available discounts, and deliver vendor reports.

Intelligent Payment Processing

Vendor Prepayments. Enter prepayment requests, issue prepayments, and apply prepayments to invoices as they are received. The prepayment balance is kept separate from the regular AP account.

Prepaid Expense Recognition. Assign a deferred expense schedule by AP line item. Automatically split payments between the prepaid account and expense accounts.

AP Invoice Automated Approval and Payment. Set up automatic processes to approve payments or establish an approval process to prioritize or delay payment. Designate an account from which to pay or select a payment method.

Use, VAT, and Withholding Tax Support. Automatically calculate Use and VAT taxes and prepare tax filing reports. Assign a default tax zone to each vendor. This default can be overridden during invoice entry. Tax calculation can include multiple tax items per document line, deduction of tax amount from the price, and tax on tax calculation. Acumatica also supports withholding tax calculations.

Monitor, Predict and Manage Cash Across Multiple Entities.

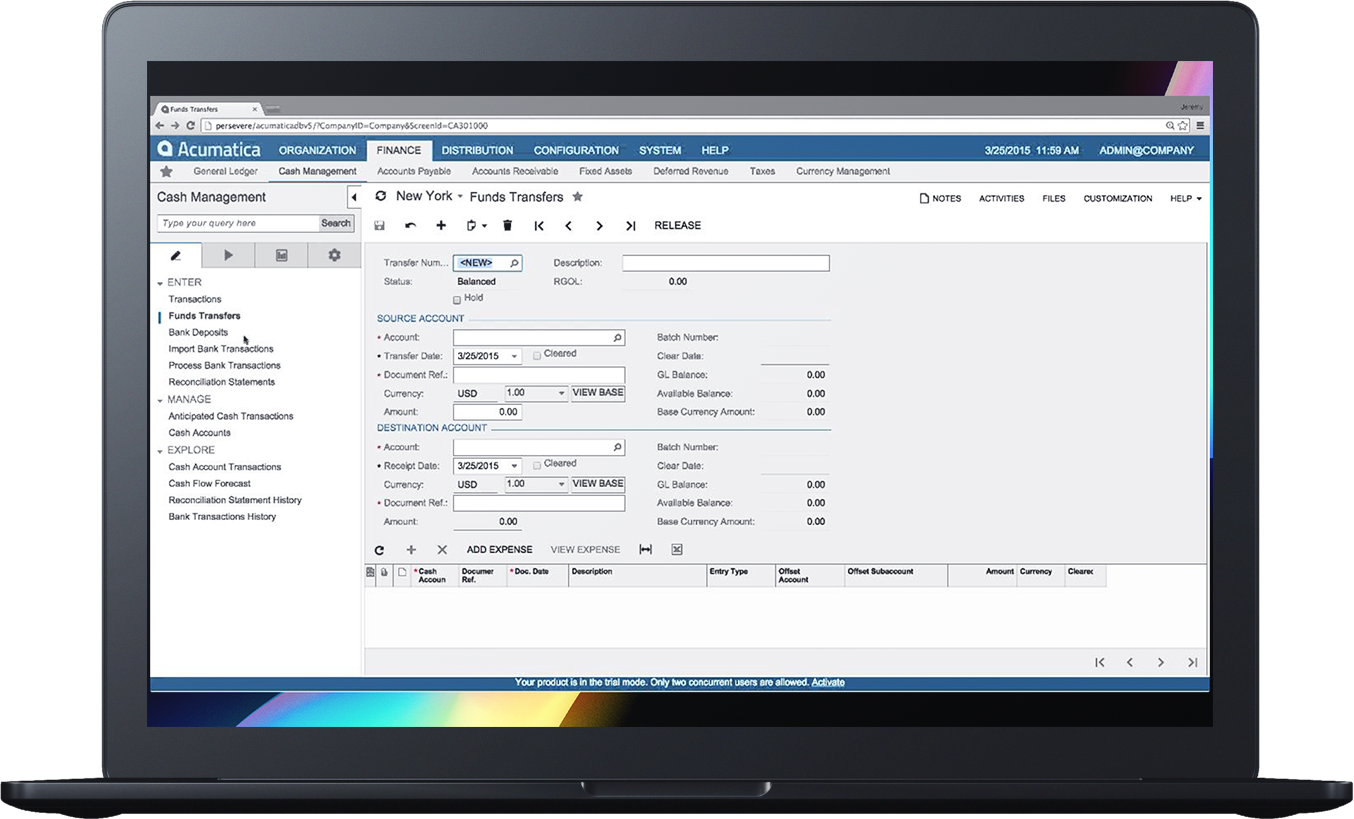

Manage all your cash needs from one place. Cash Management automatically collects all cash account transactions from General Ledger, Accounts Payable, and Accounts Receivable. It provides real-time reports with summarized views that let you drill down to account details.

Integration with financial modules. Automatically collect all cash account transactions from General Ledger, Accounts Payable, and Accounts Receivable into Cash Management for clearing and reconciliation. Transactions that are linked to a vendor or customer automatically create entries in Accounts Payable or Accounts Receivable and update the appropriate balances.

Bank account reconciliation. Simplify the reconciliation process by adding bank charges and bank interest and recording omitted cash directly from the reconciliation screen.

Cash account transfers. Transfer funds between bank accounts and track funds that are in transit. Transfer between accounts in different currencies. Automatically calculate realized currency gains or losses.

Customizable reports. Start with high-level reports and drill down to transaction details to simplify reconciliation, forecasting, and reporting.

Conduct Business Globally Using Advanced Features to Support International Subsidiaries, Vendors, and Customers.

Save time managing international subsidiaries and operations. Currency Management automatically computes realized and unrealized gains and losses, performs account revaluations, and translates financial statements. Operations in multiple currencies become available through all Acumatica financial modules.

Realized gains and losses calculations. Automatically calculate realized gains and losses from foreign currency transactions entered into any financial module. This can include receiving payments from customers, issuing payments to vendors, and transferring funds between accounts.

Unrealized gains and losses adjustments. Create adjusting entries for unrealized currency exchange gains and losses. Automatically prepare auto-reversing entries in General Ledger for all open documents recorded in foreign currencies.

Financial statement translation. Manage subsidiaries that operate in a foreign currency—or prepare your financial statements in a foreign currency. Translation of the trial balance follows FASB-52 standards. Automatically calculate translation gains and losses. Automate the consolidation of financial statements from multiple subsidiaries in combination with the General Ledger module.

Maximize Revenue Opportunities Through Improved Cash Flow, Highly Accurate Billing, and Superior Customer Service.

Tailor your billing models to the needs of your business. Acumatica Recurring Revenue Management automates your recurring billing. Enjoy the flexibility to adapt as your business grows and your billing needs change.

Automate billing. Automate recurring billing, payments, and collections to significantly improve business performance. Use templates to set up revenue billing rules for different products and services with automated revenue generation, recognition, and allocation.

Manage complex products and pricing models. Flexible pricing models make it easy to accommodate software licenses, subscriptions, maintenance agreements, bundled items, SaaS, and complex discount arrangements.

Change billing contracts. Modify, rewrite, and cancel billing contracts and revenue recognition schedules already in progress.

Automate Financial Reporting, Vendor Payments, Cash Management, and Intercompany Goods Transfers Across Multiple, Related Companies.

Track financials and create reports for an unlimited number of related companies within your organization. Related companies with the same charts of accounts, financial periods, and currencies benefit from real-time consolidation reports. Intercompany transactions are automatically calculated between related companies for both financial and inventory-related transactions. This automation allows you to manage centralized bill payment seamlessly, share customers, and automate intercompany journal transactions and intercompany goods transfers.

Company-based reporting. Maintain individual ledgers for each company. You can eliminate intercompany transactions automatically when reporting across multiple companies.

Centralized payments. Let companies purchase goods and services that are approved and paid for by other companies. Generate profitability reports that reflect the purchase at the company level.

Centralized invoicing. Initiate sales orders from one company that are invoiced and collected by a centralized accounting team from a different company.

Inventory assignment. Assign warehouses and inventory to specific companies. Inventory transfers initiate intercompany transfers to preserve company-level reporting.

The Benefits of Choosing the Acumatica Cloud Financial Management System

Increase Productivity

Automate processes with artificial intelligence and machine learning. Close books faster with Acumatica’s time-saving automation and workflow. Minimize month-end errors.

Flexible, Real-time Reporting

Create reports without programming experience or modify hundreds of pre-configured reports. Drill down from profit and loss all the way to source journal transactions. Connect data from across the system for a single version of the truth.

International Capabilities for Multiple Entities

Reach international markets with cloud multicurrency, multilanguage, and multi-company capabilities. Integrate financials across multiple business entities. Automate reporting, consolidation, payments, and cash management.

Improve Decision-making

Gain deeper insights with connected Business Intelligence, pivot tables, reporting, and generic inquiries. Slice financial reports by product, department, or any user-defined segment using sub-accounts.

Enjoy a best-in-class business management solution for transforming your company. Built on a future-proof platform with open architecture for rapid integrations scalability and ease of use Acumatica delivers unparalleled value to small and midmarket organizations.

Whether you’d like to maintain a robust fixed assets register, or asset account, for your property, plant, and equipment, or require visibility of KPIs that support your currency management strategies. Acumatica is heard to allow your company to thrive today and in the future.